Could the Lack of an NFL Resolution 'Lock Out' Display Ad Revenue for NFL.com?

Much ado has been made about the significant economic impact a National Football League (NFL) lockout would have on merchandising, Fantasy Football publications, stadiums and sports bars. Even as it looks like owners and players could come to a deal as early as this week, the potential losses that could be brought about by a lockout continue to loom over the professional football industry.

Much ado has been made about the significant economic impact a National Football League (NFL) lockout would have on merchandising, Fantasy Football publications, stadiums and sports bars. Even as it looks like owners and players could come to a deal as early as this week, the potential losses that could be brought about by a lockout continue to loom over the professional football industry.

Estimates suggest millions of dollars could be lost by each city with an NFL team, with collective losses in the billions.1 Also at the forefront of the discussion are TV networks and advertisers, who face an estimated $3 billion in losses should an NFL season disappear from the networks.2 In addition to all these, the potential impact a lockout could have on online advertising should be factored in, considering what’s at risk for advertisers – losing key male targets who traditionally spend a large amount of time on official league sites such as NFL.com.

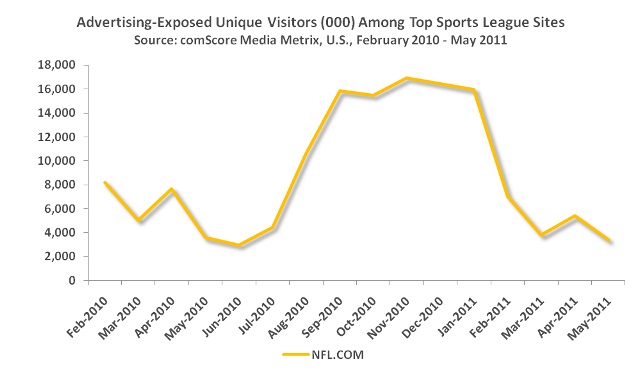

Among the top 3 U.S. sports league sites (MLB.com, NBA.com and NFL.com), NFL.com attracted the greatest number of unique visitors during its most recent active season, who were in turn exposed to a significant volume of display advertising on the site. During the 2010-2011 playing season, NFL.com averaged more than 16 million monthly ad-exposed unique visitors and generated the highest number of unique visitors among all three sites in a single month with nearly 17 million unique visitors in November 2010.

However, portending possible effects a lockout could have on NFL.com, the off-season traffic spike in April (which coincides with the NFL draft) was notably lower in 2011 for NFL.com with 5.4 million unique visitors compared to 7.7 million unique visitors in 2010. With professional football having a shorter season than the NBA or MLB, the NFL’s website may have the most to lose from a season cut even shorter by a lockout.

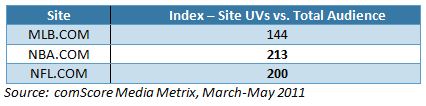

A demographic analysis of the audiences for these three sports leagues reveals an overrepresentation (i.e. index greater than 100) among males age 18-34, a particularly attractive demographic for advertisers. With 18-34 year old males visiting more pages on these sites on average, they are exposed to a relatively higher amount of advertising.

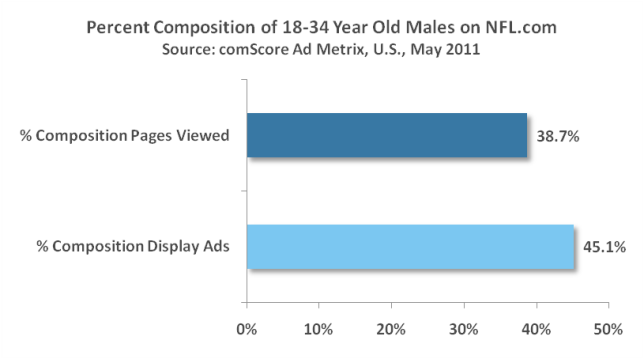

A look at May 2011 Comscore Ad Metrix data for NFL.com reinforces this point by showing how closely the percent composition of pages viewed by 18-34 year old males lines up with the percent composition of display ads seen by this demographic. 38.7 percent of all pages viewed on NFL.com were viewed by 18-34 year old males, contributing to the high percentage – 45.1 percent – of display ads seen by this group.

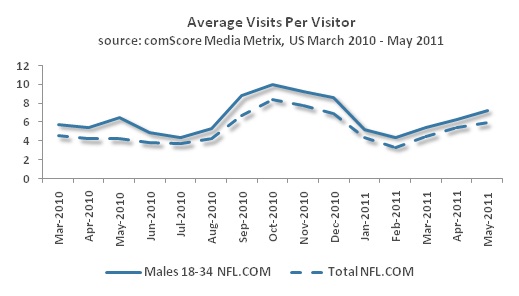

What could happen if a lockout were to persist and diminish visitation to NFL.com? Interestingly, our May 2011 data showed that while this important segment of males continued to make more visits to NFL.com than the total audience, they averaged fewer pages per visit – to the point of almost converging with the site’s total audience. Could this decline in page view behavior mean visitors from this group were checking on the latest negotiation news and, seeing nothing promising, and moving on to other sites?

It’s important to note that in spite of all this, the number of total display advertising impressions in April 2011 did not decrease for NFL.com compared to the previous year. But more complete insights are needed to fully understand longer-term changes to visitor behavior in the face of an event with as far-reaching implications as a lockout. Continuing developments even in the negotiation process could have affected consumer behavior and advertisers in ways that might not be reflected in online advertising spend or display ad impressions.

Even with a resolution potentially on the horizon, a few questions remain. Will the prolonged negotiations continue to have an effect on the average number of pages per visit following a resolution? Because a lack of previous NFL activity may have caused 18-34 year old males to shift their online surfing time to other sites, will visitation to NFL.com continue see a decline in the average time spent on the site? Or will the impending resolution cause pent up demand from NFL fans to create a surge in traffic to NFL.com, with users spending even more time than before and visiting more pages to get up to speed on the season outlook? Even as it appears the NFL may come to terms on a new deal, it remains to be seen whether or not advertisers might change their mind as the year continues.

1. http://www.sportsnetworker.com/wp-content/uploads/2011/04/www.focus_.png

2. http://www.adweek.com/news/television/nfl-lockout-looms-billions-advertising-stake-125898?page=2